Contact:

Kristen Millnick

media@drugpolicy.org

Washington, D.C. – September 27, 2023 – Today the Senate Banking Committee marked up and passed the Secure and Fair Enforcement Regulation (SAFER) Banking Act (S. 2860) out of committee in a 14-9 vote. This bill was introduced last week as an updated version of the Secure and Fair Enforcement of Banking (SAFE) Act (S.1323) – a bill that the Drug Policy Alliance (DPA) and Cannabis Regulators of Color Coalition improved prior to its introduction and had been working to strengthen it to promote fairness in marijuana banking. While it’s encouraging to see some positive changes that promote fairness for small and minority businesses, important fixes are still needed to ensure small businesses and people with past marijuana criminal convictions aren’t left behind.

Maritza Perez Medina, Director of the Office of Federal Affairs at the Drug Policy Alliance, released the following statement:

“Although DPA acknowledges minor and technical changes in the SAFER Banking Act that reflect our ongoing efforts to ensure marijuana banking legislation promotes fairness for small and minority businesses, we continue to take a position of neutrality on this bill. This is because SAFER fails to explicitly ensure that federal banking regulators will issue guidance that is fair for individuals with past marijuana criminal records. By failing to address the “red flag” issue, people with previous marijuana convictions may continue to be denied access to banking services. Despite leaving this issue unaddressed in the bill, Congressional leaders can still urge the Treasury Department to fix this problem when it updates its guidance for banks. We look forward to continuing our work with Congress and the administration to ensure fairness and equity remain at the center of federal marijuana policy reform.”

As originally identified by the Cannabis Regulators of Color Coalition, existing guidance from federal banking regulators considers criminal records, including past marijuana criminal records to be “red flags” or an automatic indication that a business may be engaged in illegal activity. A banking customer with a red flag may be rejected for banking services, have their accounts shut down, or face greater fees compared to other customers. Since the federal guidance was issued in 2014, many states have laws that have sought to expunge records associated with past marijuana criminal records and/or allow individuals with past marijuana criminal records to participate in state regulated markets. Without this change to SAFER, past marijuana criminal records may continue to be viewed as ‘red flags’, preventing individuals lawfully participating in state regulated markets from having fair access to banking. Given the vast racial disparities in marijuana arrest rates, this type of policy both disproportionately impacts Black and brown business owners who already face disparities in access to traditional banking and thwarts state laws promoting criminal justice and regulatory reform.

To address this issue, DPA advocated for amending the SAFER Banking Act to ensure that updated guidance created an exception for expunged marijuana criminal records; criminal records for activity that is no longer illegal in the state; and criminal records for activity that no longer disqualifies an individual from obtaining a state marijuana business license. DPA also sought additional amendments to promote fairness and improve data collection and reporting.

Although the SAFER Banking Act is moving forward without these improvements, DPA and our allies will continue to advocate for explicit protections for individuals with past marijuana criminal records in future reforms through legislative and executive action. Notably, the Treasury Department can update their guidance to resolve the red flag issue despite it not being explicitly required in the SAFER Banking Act.

DPA appreciates the efforts of Senator Warnock at today’s hearing to recenter the conversation on Congressional marijuana legislation around those who have been most harmed by federal marijuana criminalization. For too long this year, the interests of investors and banks have been given greater priority over issues such as community reinvestment and criminal justice reform. While these issues cannot be directly addressed in today’s hearing, DPA looks forward to working with Congress to ensure that federal marijuana reform does not stop with this bill.

###

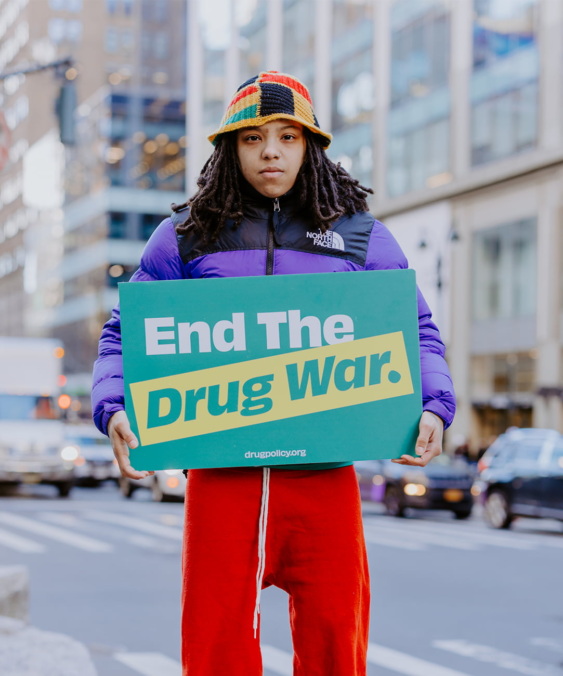

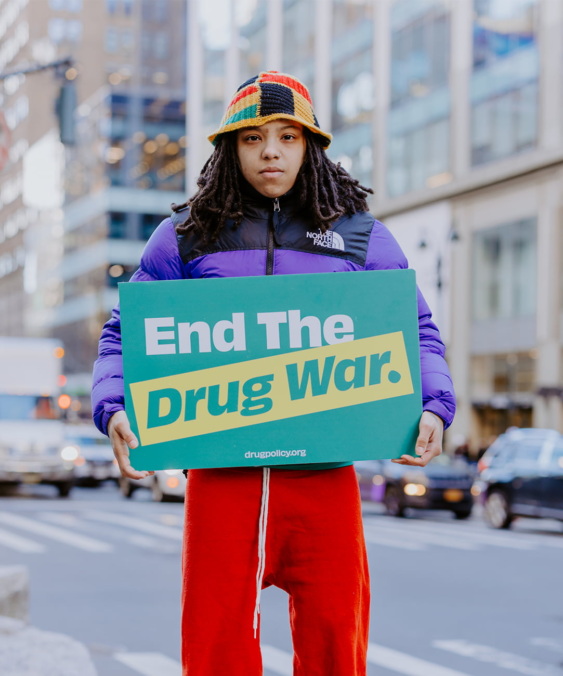

About the Drug Policy Alliance

The Drug Policy Alliance is the leading organization in the U.S. working to end the drug war, repair its harms, and build a non-punitive, equitable, and regulated drug market. We envision a world that embraces the full humanity of people, regardless of their relationship to drugs. We advocate that the regulation of drugs be grounded in evidence, health, equity, and human rights. In collaboration with other movements and at every policy level, we change laws, advance justice, and save lives. Learn more at drugpolicy.org.

Notifications