Contact:

Matt Sutton 212-613-8026

[email protected]

Washington, D.C. – Today, the Secure and Fair Enforcement Act, or “SAFE Banking Act,” was reintroduced in the U.S. House and Senate. The bill includes new provisions to ensure timely and more comprehensive data collection and reports that are inclusive of the hemp industry, veteran-owned businesses and small businesses. These are changes the Drug Policy Alliance (DPA) and the Cannabis Regulators of Color Coalition (CRCC) fought to include. Additional positive changes to the bill include granting marijuana workers access to federal mortgage loans and explicitly extending the bill’s protections to Community Development Financial Institutions (CDFIs), another provision DPA and CRCC advocated for.

The SAFE Banking Act would not change the legal status of marijuana. Instead, it would grant banks “safe harbor” to offer financial services to state-licensed marijuana and hemp businesses. It would also require the Treasury to update guidance to banks and report to Congress on aspects of the marijuana and hemp industry and banking. Although some financial institutions currently provide limited services to marijuana-related businesses, such as checking accounts, many do not offer their full range of services–including commercial loans–due to potential federal enforcement.

The lack of access to commercial loans particularly harms small and minority-owned marijuana businesses. Given the existing racial disparities in the banking industry, coupled with the continued federal criminalization of marijuana, Black and Brown-owned marijuana businesses will likely face exacerbated challenges towards securing access to financial services. This creates considerable challenges in these businesses being able to compete with large, predominantly white-owned multi-state operators in the marijuana industry. This will continue, and these large operators will remain in full control of the industry, unless intentional policies are established to promote fair access and opportunity.

Maritza Perez Medina, Director of the Office of Federal Affairs at the Drug Policy Alliance, released the following statement:

“The improvements to the study and data collection provisions in the SAFE Banking Act are a welcome addition to the bill. These minor modifications to the bill will ensure that timely and more comprehensive data collection takes place to measure whether banking services are being provided in a fair way. While there remains much more work to be done and we remain neutral on the legislation, the changes are an encouraging sign that the bill is headed in the right direction. As this legislation moves forward, more should be done to lessen the barriers to entry small marijuana businesses face in obtaining commercial lending. Without this, it remains impossible for them to compete with large, multi-state operators. As such, we look forward to continuing working with stakeholders to improve this bill in a way that most benefits the communities that have been disproportionately impacted by prohibition.”

Dasheeda Dawson, Chair of the Cannabis Regulators of Color Coalition, released the following statement:

“We are delighted to see the SAFE Banking Act reintroduced with some of the changes we have been advocating for. However, more needs to be done to establish a fairer playing field – especially for those that have been most harmed by prohibition and continue to face extreme barriers to entry. For example, with relatively minor changes, SAFE could ensure that marijuana criminal records are not automatically considered a ‘red flag’ or part of what financial banking regulators consider an indication that a business may be engaged in unlawful activity. Without this type of change, marijuana criminal records will continue to be a significant barrier towards participation in state-legal marijuana industries, disproportionately impacting Black, Latinx and Indigenous entrepreneurs. It could also lead to federal interference against state licensing programs that have attempted to create more diverse ownership opportunities. Incorporating these additional technical changes to the bill could go a long way in ensuring commercial lending access for minority and directly-impacted marijuana businesses.We look forward to working with SAFE’s Congressional champions and the Senate Banking Committee to strengthen and ensure justice and fairness are central to this bill.”

For more information, please see DPA’s recommendations for improving SAFE.

###

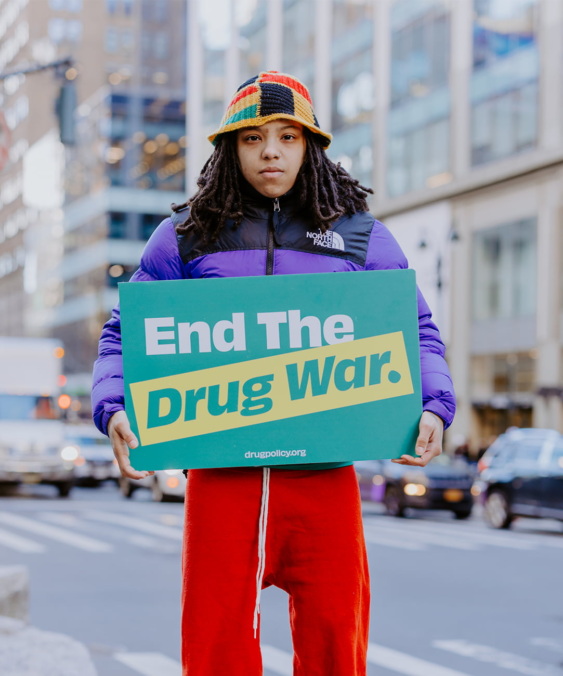

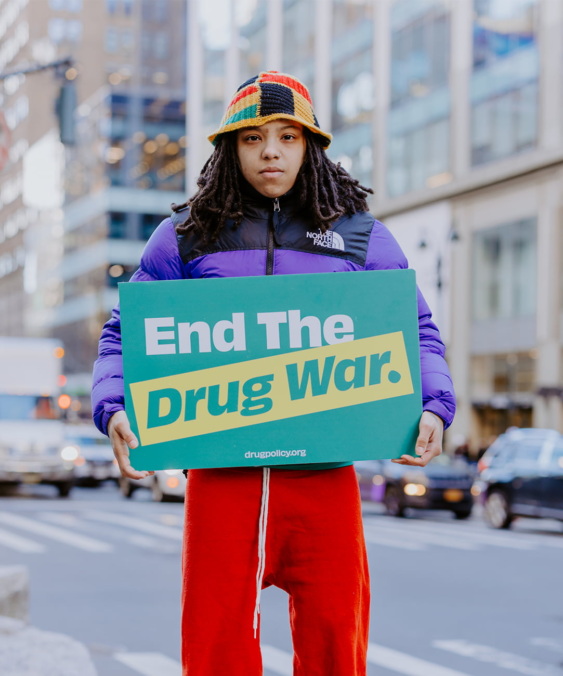

About the Drug Policy Alliance (DPA)

The Drug Policy Alliance envisions a just society in which the use and regulation of drugs are grounded in science, compassion, health and human rights, in which people are no longer punished for what they put into their own bodies, and in which the fears, prejudices and punitive prohibitions of today are no more. Our mission is to advance those policies and attitudes that best reduce the harms of both drug use and drug prohibition, and to promote the autonomy of individuals over their minds and bodies. Learn more at drugpolicy.org.

About the Cannabis Regulators of Color Coalition (CRCC)

The Cannabis Regulators of Color Coalition (CRCC) is a coalition of current and former government officials appointed and/or selected to lead, manage and oversee the regulatory and policy implementation for legal medical and adult-use cannabis markets across the United States and abroad. As leaders in post-prohibition cannabis policy, who focus on equity-centered regulation, industry best practices, and cannabis competency and standardization, their mission is to be a source of education for legislators and government agencies that aim to identify and eliminate racial disparities in cannabis policy and build sustainable cannabis regulatory frameworks designed to deliver on the reparative and restorative potential of the global cannabis legalization and decriminalization movement.