<h2 class="subtitle">

Contact:</h2>

<p>Lynne Lyman (213) 210-1023<br />

Glenn Backes (916) 202-2538</p>

SACRAMENTO — Today, civil asset forfeiture reform legislation authored by Senator Holly Mitchell (D-Los Angeles) and David Hadley (R-Torrance) passed the Assembly Floor by a 67 to 7 vote.

The bill will require that in all cases where law enforcement seize cash under $40,000, that there be a conviction in the underlying criminal case, before that money flows to law enforcement coffers. The same protection would be afforded homes, land, and vehicles, regardless of value. Under current law, there is not such protection for cases sent into the federal system, and the current threshold for cash in state law is $25,000, established in 1994.

Senate Bill 443 now heads back to the Senate Floor for a concurrence vote, before moving on to Governor Brown for his signature or veto. Last year, despite strong bipartisan support in the State Senate, law enforcement lobbyists were able to delay the bill in the Assembly, claiming losses in revenue would cripple crime-fighting efforts.

After extensive negotiations with the law enforcement associations representing District Attorneys, police chiefs and sheriffs, the authors and proponents of the bill agreed to amendments that would remove most law enforcement opposition. With the amendments taken, a bill that is still considered a very significant reform, passed today with overwhelming bipartisan support.

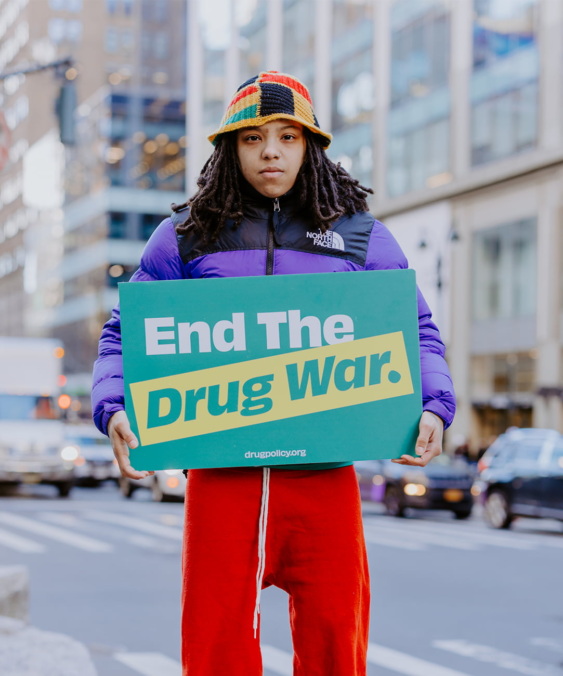

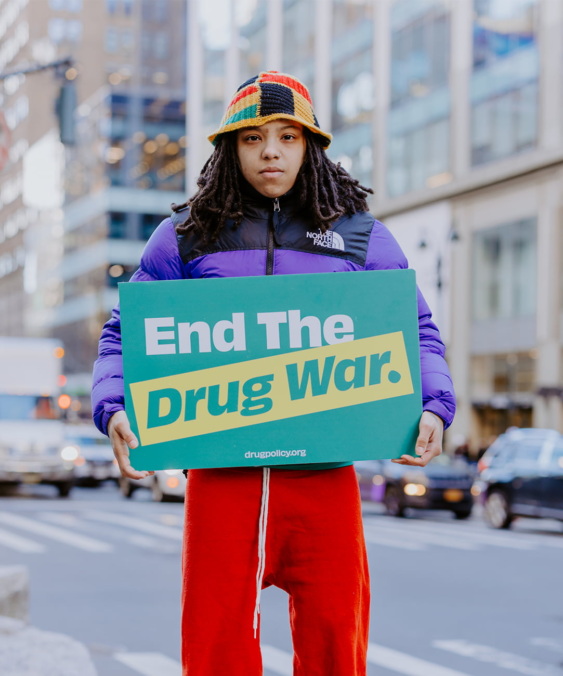

“This important legislation will drastically reduce the opportunity for police to take money from and otherwise harass poor people, immigrants, people of color, and small businesses that work primarily in cash,” said Lynne Lyman, California state director of the Drug Policy Alliance. “If Governor Brown signs this bill it will be one of the most far reaching civil asset forfeiture reforms in the country and will once again demonstrate that states are taking the lead to protect people’s due process and property rights.”

SB 443, co-sponsored by the Drug Policy Alliance, ACLU, the Institute for Justice, the Ella Baker Center, and the Coalition for Humane Immigrant Rights of Los Angeles, was amended last week to require that in all cases involving less than $40,000 cash, a home or vehicle, that there be a criminal conviction before assets are deposited into local law enforcement coffers. Data from the US Department of Justice and state Attorney General’s Office shows that the majority of cases involve cash under the $40,000 threshold.

Civil asset forfeiture law allows the government to seize and keep cash, cars, real estate, and any other property. While civil asset forfeiture was originally conceived in the 1980s as a way to target and drain resources away from powerful criminal organizations, it has primarily become a method for law enforcement to confiscate the savings and property of those not even charged with any criminal wrongdoing. California law generally requires a conviction before property is permanently forfeited to the government, and protects guiltless spouses, in a way that federal law does not. In the last 20 years since California implemented these protections, many law enforcement agencies chose to exploit a loophole in the law that allows them to transfer cash and property to the federal government, which shares the proceeds from the forfeiture with the local agency, even when there was no arrest, charge or conviction.

There is an emerging bipartisan national consensus that asset forfeiture requires substantial reform. In 2016 alone, at least 22 states have introduced bills to limit civil asset forfeiture. Reforms have been enacted in eight states (Florida, Maryland, Mississippi, Nebraska, Oklahoma, Tennessee, Virginia, and Wyoming) and several others are currently pending. . Of the enacted state reforms, Nebraska and Maryland addressed the federal equitable sharing loophole and require, in part, that the property exceed a certain value before the property can be transferred for federal forfeiture proceedings. However unlike SB 443, these reforms do not connect equitable sharing payments to a conviction requirement. SB 443 seeks to ensure that state and local agencies abide by stricter standards before they profit from federal forfeitures.

At the federal level, the U.S. House is expected take up a civil asset forfeiture reform bill in September. Known as the ‘‘Deterring Undue Enforcement by Protecting Rights of Citizens from Excessive Searches and Seizures (DUE PROCESS) Act of 2016,” this bill would help give property owners fighting a federal civil asset forfeiture action greater leverage to contest a government seizure and increases the federal government's burden of proof in civil forfeiture proceedings. The DUE PROCESS Act, however, as currently formulated, does not address the “policing for profit” incentives perpetuated by the federal equitable sharing loophole. A separate bill introduced in 2015 by Senator Rand Paul (R-KY) in the Senate and Rep. Tim Walberg (R-MI) in the House and known as the Fifth Amendment Integrity Restoration (FAIR) Act would go a critical step further to eliminate the Department of Justice’s Equitable Sharing Program that has incentivized state and local law enforcement to transfer cash and property in circumvention of state law. Although the FAIR Act is not expected to advance in Congress this year, lawmakers in Congress should follow the lead of the California legislature and amend the DUE PROCESS Act to eliminate the Equitable Sharing Program.

Among the California members of Congress who have co-sponsored a version of the FAIR Act: Representatives Tony Cardenas (D-San Fernando Valley), Sam Farr (D-Carmel), Tom McClintock (R-Roseville), Judy Chu (D-San Gabriel Valley), Ted Lieu (D- Manhattan Beach), Mark DeSaulnier (D-San Francisco East Bay), Janice Hahn (D- Los Angeles Harbor Region) and Dana Rohrabacher (R-Costa Mesa). Rep. Cardenas issued a statement last year noting that “satisfying a profit motive must never be the reason for law enforcement.”

In 2015, the Drug Policy Alliance released “Above the Law: An Investigation of Civil Asset Forfeiture Abuses in California,” a multi-year, comprehensive look at asset forfeiture abuses in California that reveals the troubling extent to which law enforcement agencies have violated state and federal law, with many of the worst violators clustered in the Los Angeles County region. It also revealed that law enforcement agencies' revenue from state forfeitures remained flat while their revenue from federal forfeitures more than tripled during the same time period.

Notifications